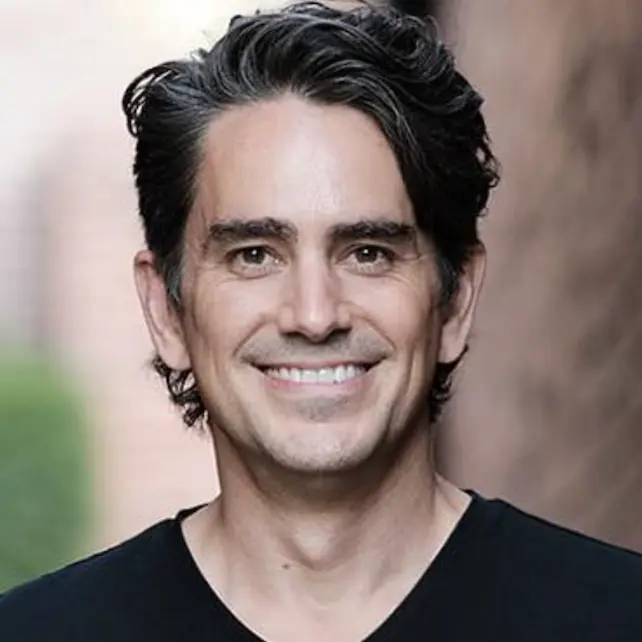

Walker Deibel’s hair? On a scale of iconic, it ranks just below the Bloomin’ Onion at Outback Steakhouse.

Just him and Patrick Dempsey, out-hair-ing everybody.

Male pattern baldness? Pfft. Not on their Apple Watches.

Beyond his thick, wavy mane, Walker Deibel is the author of Buy Then Build, a #1 bestseller on Amazon.

He’s also the founder of Acquisition Lab, an $8,500 coaching program designed to teach acquisition entrepreneurs how to buy businesses, bypassing the messy challenges of starting from scratch.

Read on for Acquisition Lab reviews.

Here’s a sobering fact:

Less than 1% of startups ever exceed $1 million in annual revenue.

What if you flipped that around and acquired a business that already has:

- Product-market fit

- Current customer relationships

- Existing infrastructure

- And positive cash flow

You could virtually guarantee you break into that 1%, couldn’t you?

And, believe it or not, you can buy such a company for the average down payment of a house, with a bank loan for the rest.

For easy math, say you bought a business for $1 million.

You put 10% down, or $100,000.

You finance the remaining $900,000.

If all’s you do is grow revenue by 10% per year, that initial $100,000 investment balloons to about $2.25 million in equity value after 10 years.

You might be thinking: yeah, well, if my mom had balls, she’d be my dad.

But here’s where you’re mistaken, Walker argues. Statistics show that the success rate for acquisition entrepreneurship is over 98%.

That’s nearly four times higher than you’d see with venture capital investing.

Combine this with the $10 trillion in business value held by retiring baby boomers, and it’s clear this opportunity is nothing short of heavenly.

If we could rip the sky apart and take a peek, like a chubby kid popping his head into a treehouse, we’d probably see Christ the Lord giving a knowing nod.

The wealth transfer set to occur over the next few years due to this trend will be enormous.

Business acquisition is a top elective for prestigious MBA programs for good reason.

I blacked out and woke up in a puddle of drool while Walker droned on about his jargon-filled approach to buying a business.

EBITDA this, get upstream that, deal flow, certified M&A advisor – honestly, just kill me and use my rotting remains to fertilize the lawn.

I don’t have the patience or the aptitude for this level of complexity.

What I need is the business equivalent of a Lego set intended for 6-8 year-olds.

Walker is in a different league.

- He’s cofounded three startups.

- Acquired seven companies outright.

- He’s a minority investor in 24 others.

- Enjoyed two successful exits.

- Earned his MBA.

- Been licensed by the SEC.

- Even authored a book on everything he’s learned.

If you’re cut from the same cloth, he invites you to join his Acquisition Lab.

Owning a business is the fastest way to real wealth for most people, Walker pitches.

He’s dedicated his life to helping others achieve this, offering his expertise at what he considers a sensible price point of $8,500.

I think that’s a little steep. But then again, I’m someone who pats his belly and screams, “Yummy in my tummy!” after downing a bowl of SpaghettiOs, so consider the source.

Anyways.

Through stepwise instruction, group coaching, essential tools, and a supportive community, Walker guides anyone determined to buy a company straight to the promised land.

What’s the takeaway?

With solid testimonials backing the Acquisition Lab, it would appear you’re in capable hands – assuming you’re a good fit and commit to your part once enrolled.

I’ll be here, sobbing into my keyboard, as you ascend to the big leagues.